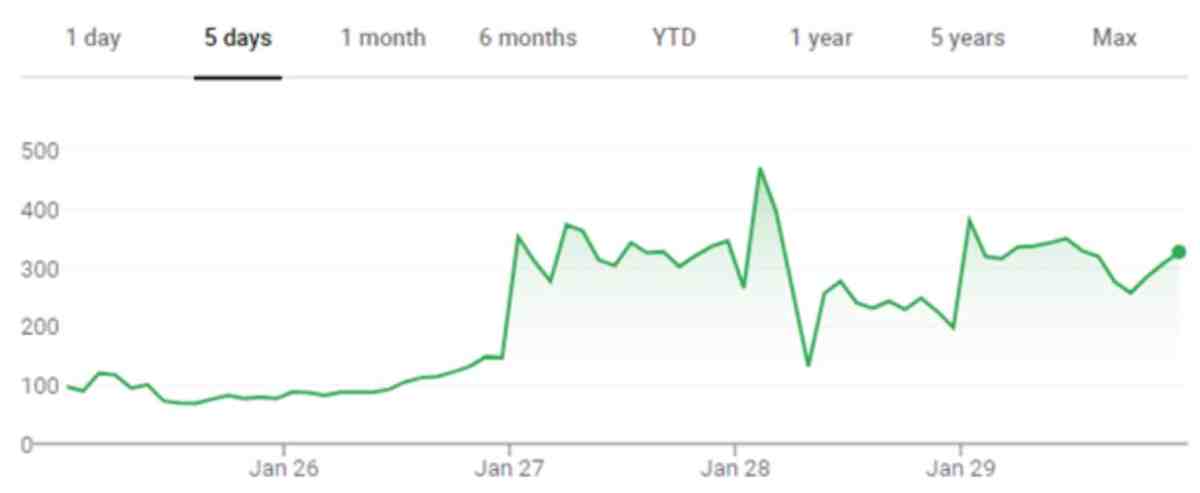

If you’ve followed the news this week, you know that GameStop and a few other struggling stocks have been the center of a wild trading frenzy. In just a few days, GameStop stock went from $145 up to $469, down to $132, and then back up to $379.

If you didn’t know better, you might think that traders were trying to design a theme park roller coaster. Hard as it may be to believe, the actual explanation is just as bizarre, but a lot more entertaining. This week, I’ll provide an accessible breakdown of what happened and why. Then, in my next column, I’ll answer the burning questions people have been asking about the legal consequences of the GameStop incident.

The Battle Over GameStop Didn’t Start This Week

The fact is GameStop has been struggling for years. While gaming as a whole has grown, most of that growth has been through digital sales. The consequences were hardly surprising: GameStop store closures, rumors of bankruptcy, and increasingly terrible policies for employees. At one point, GameStop even attempted to sell itself — though, as with everything GameStop, the price it offered was too high.

GameStop’s financial difficulties attracted the attention of several hedge funds and Wall Street-type investors that predicted that GameStop was doomed to failure. Based on that prediction, the investors “short-sold” GameStop stock. For those who haven’t heard of shorting stock, Forbes offers a simple explanation:

Normally, savvy investors buy stocks at low prices, hold the stocks and then sell them at high prices on a later date. The whole idea is that you think a particular company is poised for big future growth, like Tesla, Inc. (TSLA), so you buy and hold the stock.

Short selling takes the opposite approach. You borrow shares of stock from a big institutional investor (for a small fee), sell the shares at the current market price and then wait for the price to decline. Once the price of your target stock falls low enough, buy back the shares, return them to the lender and pocket the difference.

But investors were hardly unanimous in their valuation of GameStop. While a sizable group of institutional investors bet on GameStop to fail, numerous other investors — including a nontrivial Reddit contingent — thought that GameStop was undervalued, and they invested in the company with a prediction that its stock price would increase.

For a while, the different investment approaches were little more than simple differences in opinion. But as time passed, the short-sellers became more aggressive in their bets — in the days before the stock market explosion, the short-seller investors had sold or optioned over 160% of all GameStop stock. That means that short-sellers had sold more shares of GameStop than there were shares in the market and that there was not sufficient stock for the short-sellers to buy back their shares to cover their positions.

Those conditions made GameStop stock ripe for a “short squeeze.” As explained by Investopedia, “a short squeeze occurs when a stock or other asset jumps sharply higher, forcing traders who had bet that its price would fall to buy it in order to forestall even greater losses.” The investors who bet on GameStop to succeed saw that the stock was over-shorted and recognized that even a small increase in demand for the stock would pressure short-sellers to cover their position for fear of greater losses. This, in turn, would increase demand even more, since short-sellers cover their position by purchasing stock, which would drive the price even higher.

Reddit Lights the Powder Keg

This is where Reddit really starts to take center stage. The subreddit /r/wallstreetbets has millions of members who trade stock tips and work together to identify and take advantage of market trends and inefficiencies. As with memes, it’s difficult, if not impossible, to explain why a particular trend rises to popularity at any given time. Here, however, the longstanding disagreement between the GameStop short-sellers and the GameStop believers, in tandem with the fact that institutional investors had recklessly overextended their positions, means that a short squeeze was seemingly inevitable. And once the stock started to move, the strong communication among members of the subreddit created a snowball effect that led more and more personal investors to hop on to the GameStop train. This, in turn, magnified the short squeeze that many reddit investors had predicted, causing institutional investors to close their positions before it was too late.

All told, the price fluctuations were so significant that they triggered the market’s “circuit breaker,” resulting in a temporary halt in all trading on those stocks to give the market a “cool down” period to give investors time to respond to the changing market conditions.

So What About Robinhood?

Robinhood is an app that is used to facilitate stock trades. Until recently, individual investors seeking to play the stock market would have to rely on broker companies like E-Trade, which charged a commission fee for each trade. In 2013, Robinhood made it possible to trade without commissions — something that led to a substantial increase in so-called “retail investors” — non-professional investors who trade from themselves. Robinhood and commission-free trading reduced transaction costs in terms of both time and money, thus paving the way for /r/wallstreetbets and making the stock market available to the “common man.”

Robinhood played an essential role in the GameStop incident, as the app seems to be the most popular way for GameStop’s supporters to access the market. In fact, over half of Robinhood’s users have purchased GameStop stock. That matters, since, when faced with market volatility and unpredictable price swings, Robinhood prevented its users from opening any new GameStop positions — users could sell stock they previously purchased, but they were not allowed to buy new shares. As one might expect, this, in turn, led to even more volatility, as users responded to the announcement by selling off their positions, causing the stock price to plummet.

Note that Robinhood’s trading restrictions are not on the same footing as the halt on trading caused by the “circuit breakers” described above: The circuit breakers imposed a temporary halt on all trading based on predefined criteria. Robinhood’s restrictions, on the other hand, only applied to Robinhood users, only prevented users from opening new positions, and seem to have been imposed on an ad hoc basis.

While Robinhood has since eased its trade restrictions (somewhat), its actions have drawn the ire of the general public, as many believe that Robinhood suspended trading to protect institutional investors from further losses, at the expense of the common man. In this respect, memories of the 2008 housing crisis are all too fresh — institutional investors and big banks can profit at the expense of the average American, but when those same institutional investors act recklessly, they can rely on their size, wealth, and self-serving machinery to dull their losses — again at the expense of the common man.

The result? Robinhood has already been named as a defendant in a class action suit, lawmakers from both parties have called for hearings and increased regulation in connection with Robinhood and the market, and all parties involved are currently under scrutiny by the Securities and Exchange Commission.

But what does it all mean? Is the short squeeze illegal? Could redditors go to jail? Was it illegal for Robinhood to suspend trading as it did? Does the class action suit have legs? What does this mean for GameStop? And perhaps most importantly — did something go wrong here, or is this just the market functioning as intended? Come back next time to find out! In the meantime, you can check out this reenactment of the week’s events, as told from the perspective of the institutional investors.